top of page

Buy India’s best health insurance policies only on Practo Insurance.

These policies offer a range of benefits, including

At Practo, we understand the importance of protecting self and loved ones from the high costs of healthcare. That's why we highly recommend personal health insurance, one that covers the following :

Types of Health Insurance policies

These features can provide a comprehensive view of the two main types of retail health insurance, allowing individuals to make an informed decision about which policy best suits their needs.

Who is eligible to buy a personal health Insurance ?

Age

There is no age bar.

Residency

The individual must be a resident of India.

Health Status

Insurance providers require a medical check-up or health declaration to assess the individual's current health status and any pre-existing medical conditions.

Sum Insured

The sum insured is the maximum amount the insurance provider will pay out in the event of a claim. Some policies require a minimum sum insured, while others allow the individual to choose the amount.

Premium Payment

Regular premium payments are required to keep the policy active. The premium payment frequency and amount may vary by policy.

These are general eligibility criteria for retail health insurance policies. It is recommended to consult a Practo insurance agent or review the policy details for specific requirements before purchasing a policy.

Why should you buy a personal health insurance, if you are already covered under a corporate plan ?

While you and your family might be covered under your company’s corporate health plan, it is recommended supplementing it with a personal health insurance plan for you and your family members. Some of the advantages of having a personal Insurance policy are:

Coverage beyond employment

Personal health insurance continues to cover even after leaving the job, ensuring lifelong protection.

Customisable coverage

Allows the policy holder to choose coverage and benefits that cater to their specific health needs (e.g., saves money for family with elderly parent)

Provides higher coverage

Generally corporate health insurance offers a limited cover of 5 to 7 lacs for the entire family which is not sufficient in today's time of increasing medical costs. Having your own personal health insurance will provide you with added coverage.

Financial security

Provides financial security during medical emergencies, reducing the burden of paying large medical bills.

Freedom to choose healthcare

Policyholders have the freedom to choose the healthcare provider of their choice, ensuring the best possible medical care

Tax benefits

Get tax benefits under Section 80D of the Income Tax Act (e.g, saves up to Rs. 7,500 in taxes for Rs. 25,000 premium)

We encourage you to act now and secure your health with a retail health insurance plan. Also by signing up early, you will have more affordable and easier coverage options, and pre-existing conditions will not be an issue.

What is Practo Insurance?

Practo Insurance is another stride towards increasing the footprint of our mission - ‘Making Quality Healthcare Affordable and Accessible for all’! We are an e-platform that enables users to view, compare and purchase insurance policies that provide health or life cover as well as financial security.

What is Practo Insurance?

**

**Post online payment depending on your profile, policy can either be issued immediately or the insurer might ask for medical tests / more details to issue the policy.

Why choose Practo Insurance?

Our expertise and experience in the healthcare field give us an edge over other players. We have an in-depth understanding of the user’s healthcare needs.

This will helps us in curating plans which are ideal for the user. We guarantee financial safety and peace of mind for our users. The claim settlement and policy procurement process has been simplified for users’ seamless experience.

Top Health Insurance Partners

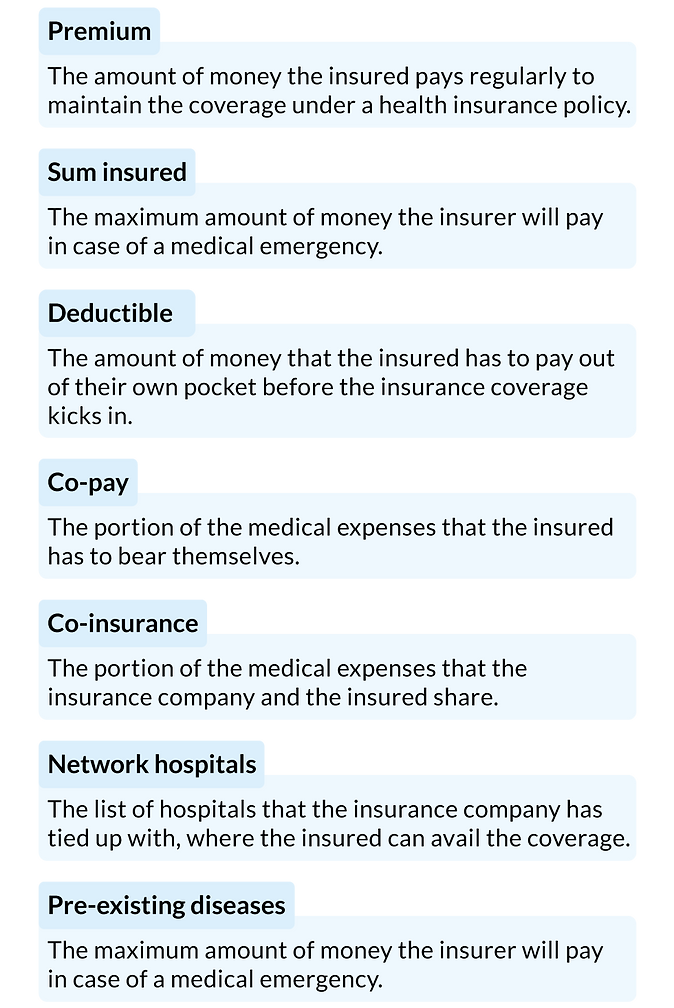

Health Insurance Terminology Simplified by Practo

It is important to understand these terms as they help in making informed decisions and getting the most out of a health insurance policy.

Registered as: Knighthealth Technologies Pvt Ltd. IRDAI Corporate Agent (Composite).

Corporate Agent Registration Code: CA786. Valid till : 26/12/2024.

Registered Address: #4272, Saptagiri, 2nd Floor, Vivekananda Park Road, Near Seetha Circle, Girinagar, Bangalore - 560098

CIN: U74999KA2019PTC130321

bottom of page